by Sean Endsley

This is generalized market opinion; please do not rely on these opinions for important decisions. We offer free personalized assessments for your specific property. We do this without obligation and often for those considering sales, estate planning and property tax disputes.

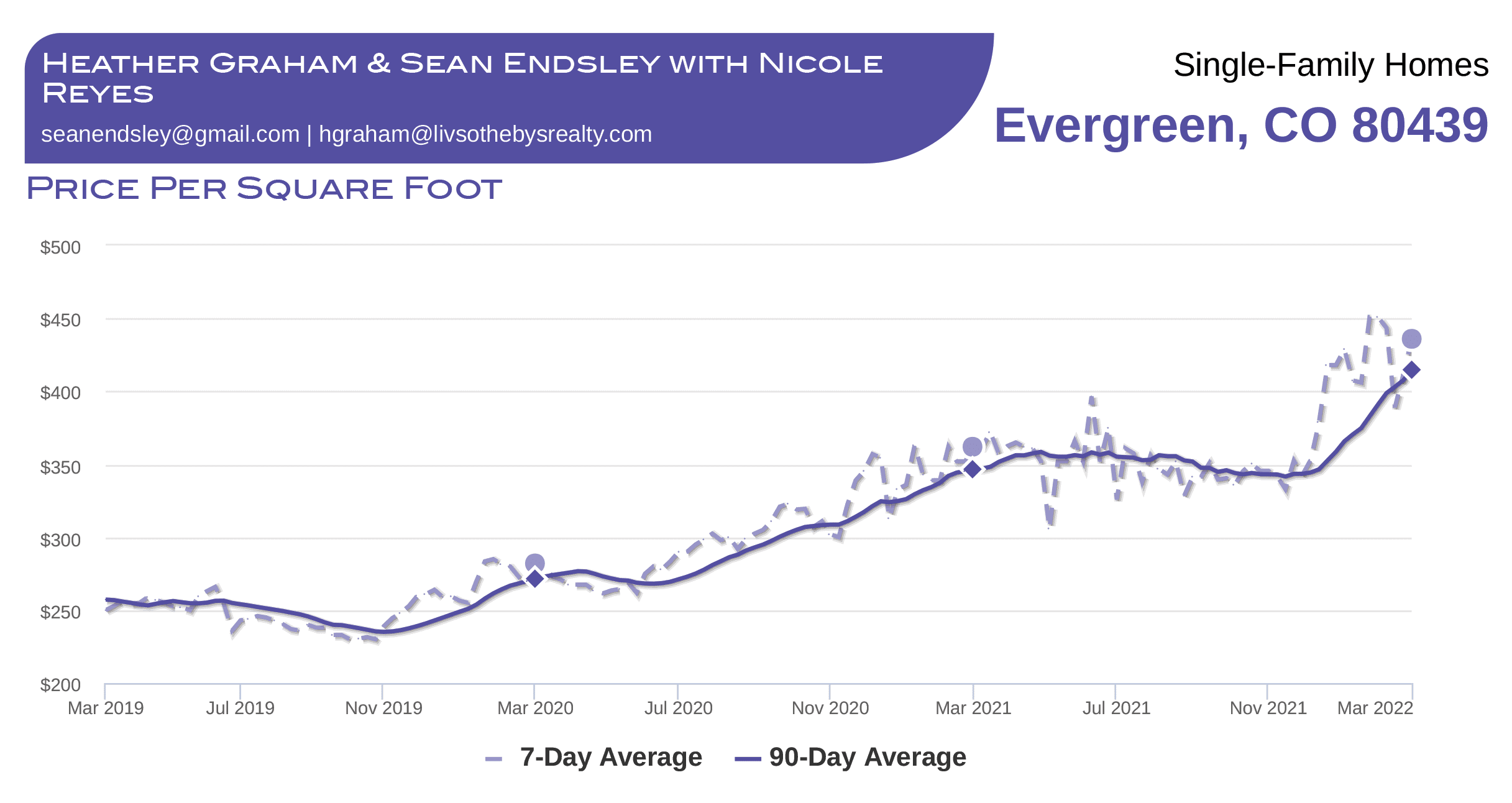

—Our market’s average price per square foot will likely increase by another 8 to 12 percent by the end of 2022 with most of that appreciation occurring in the spring and early summer.

—Median home prices for our communities will likely go up by 10 percent. Evergreen’s median list price will exceed $1.5 million for most of the year.

—A typical 30-year fixed mortgage rate will likely exceed

5 percent by the end of 2022.

—Standing inventory will measure similarly to that of 2021 which saw 700 homes hit the MLS with quick absorption, averaging just a few days on the market.

The start of our pandemic real estate market began in March of 2020 with a generalized concern that the market would freeze and values would plummet. At that time, buyers started demanding and sometimes getting price reductions mid-contract. Values were uncertain. And then, like a tsunami on an unsuspecting day, big demand showed up. The communication with our typical “feeder” markets that had always been so nuanced and so dynamic, all shook out to the same common narratives. Lifestyle migrations were being enabled and prioritized; people were moving. Big demand had arrived. Zillow reported that Evergreen, Colorado is one of the top three searched small towns for the U.S. Our market exploded, property values rose by an average of 36 percent since March of 2020.

So now what?

On the other side of demand is supply, aka inventory. And inventory is another impactful part of our story, the part that is making life so frustrating for buyers. It’s also the part that will probably keep home prices on the increase for at least the remainder of 2022. Nationally, the U.S. housing market has been underbuilt for a decade and a half according to George Ratiu, Realtor.com’s manager of economic research. Simultaneously, millennials are making the shift from renters to homeowners. Our local communities stand out in this supply and demand conundrum. Land is more scarce and more expensive here. I really should be using the term “standing inventory.” In 2019, the local MLS shows that our market closed 560 homes, while in 2020 there were 669 closings, and 2021 saw 700. Our supply, even as it increases, cannot keep up with today’s demand. There is just not a chance for inventory to stand and be reviewed or even counted, as the average home’s days on market has changed from weeks or months to just a short couple of days.

The appreciation in our market has been without precedent. In March of 2020, Evergreen’s average price per square foot was $265. Other markets in our community such as Conifer, Morrison and Golden were all close to that and enjoyed roughly the same journey. March of 2021 saw a 24 percent gain to an average of $350 per square foot, and the same measure for March of 2022 reveals a 12 percent annual gain to an average of $400 per square foot. That’s a huge two-year jump of 36 percent. It’s important to note here that smaller homes and homes with large land are also calculated within these averages driving price per square foot up. The same statistical methodology was used for all measures mentioned. Evergreen’s median list price is now $1,400,000. Two years ago it was $900,000. This 36 percent gain in our median list price is beginning to create an accessibility issue. In 2007, real estate found the threshold where home costs outpaced incomes, but lending practices enabled purchasing above this threshold to fuel the bubble that fueled the great recession. As an industry, I think that we are collectively grateful for the federal guidelines and safeguards that have thus far been effective at preventing a similar bubble scenario. It looks like from here that demand has been more organic, caused in large part by two migrations. Our area has benefitted from a population shift from East to West and a lifestyle shift from urban to rural. Work from home seems to have translated to “work from the mountains.” These causes are more sustainable and more sound, but the delta between home prices and incomes is still narrowing for many, even as the pool of buyers expands.

Interest rates are beginning to ratchet up and this will place downward pressure on the housing market. In a simplistic way of looking at it, for every 1 percent interest rates go up, a buyer can afford about 10 percent less house for the same mortgage payment. Our concern is that interest rates can be a powerful tool to slow an economy down and is being used now to counter inflation. It is typical for a recession to follow these kinds of adjustments.

A recession doesn’t have to be anything resembling the great recession of 2008, but technically just a contraction in economic activity, usually spending, and over the course of a couple of business cycles. In 2020 and 2021, we saw massive gains for many investors for most markets. Even a small recession could have detrimental effects on upward momentum of home prices. Scarcity is expected to chase away a decline in values. We are still in the territory of historic lows for interest rates, but the mental state of participants with growing assets is generally very different and less averse to large purchases than that of buyers with static or shrinking assets.

Our recommended takeaway from this year’s annual market research is that 2022 is and will be fastpitch. The speed of this market will cause mistakes, and some will be expensive. Use of local, professional, and well-networked Realtors will offer both selling and buying advantages. There is no substitute for experience. For more information, contact Sean Endsley at

LIV Sotheby’s International Realty at 303.895.4663.